Quick Answer

For Tampa high-net-worth filers in 2025, the best tax moves are: max retirement/HSA funding, bracket-targeted Roth conversions, capital-gains timing (incl. QSBS/1031), appreciated-stock gifting/DAFs, and proactive estate & annual gifting all while leveraging Florida’s no income tax and homestead protections.

Key Takeaways (2025)

-

401(k), HSA, FSA, and annual gift limits increased for 2025.

-

Florida’s no state income tax means federal planning drives savings.

-

Roth conversions + charitable bunching can offset large 2025 income.

-

Estate & trust strategies should be executed at today’s exemption levels.

2025 Federal Updates at a Glance

|

Item |

2024 |

2025 |

Why It Matters |

|---|---|---|---|

|

401(k) employee deferral |

$23,000 |

$23,500 |

Bigger pre-tax or Roth contributions |

|

HSA (self / family) |

$4,150 / $8,300 |

$4,300 / $8,550 |

Triple-tax advantage |

|

Healthcare FSA cap |

$3,200 |

$3,300 |

More pre-tax medical funding |

|

Annual gift exclusion |

$18,000 |

$19,000 |

More tax-free gifting |

|

Estate exemption |

$13.61M |

$13.99M |

Higher transfer headroom |

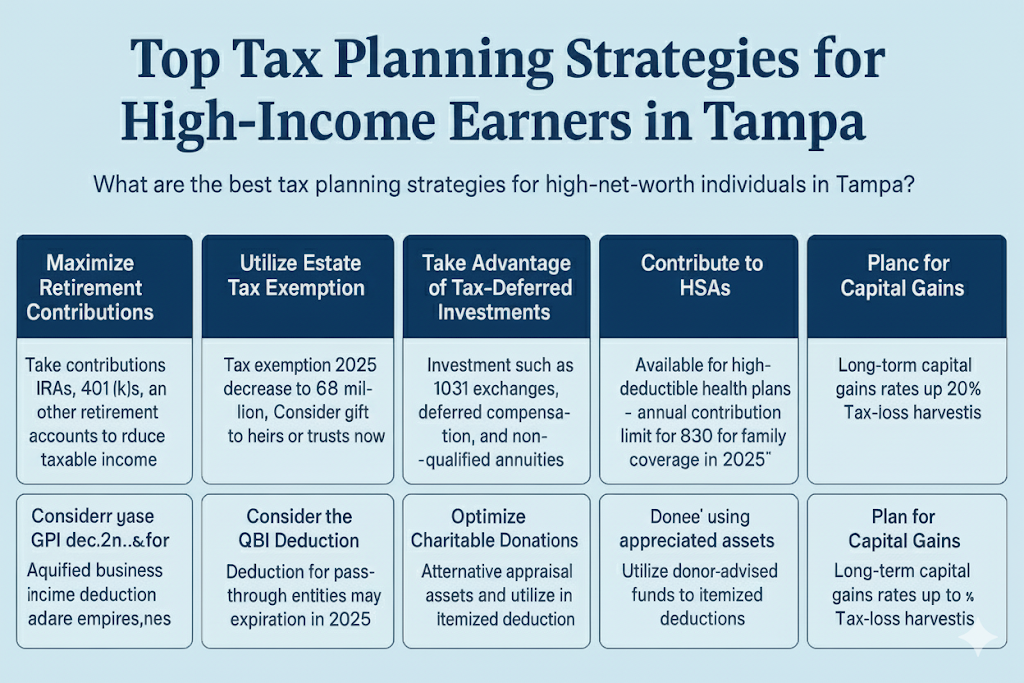

Top Tax Strategies for High-Income Earners in Tampa

1) Max Out Tax-Advantaged Accounts

-

401(k)/403(b)/457 plus age-50 catch-ups.

-

Backdoor Roth IRA if phased out of direct Roth.

-

HSAs for triple tax benefit.

-

Mega backdoor Roth via after-tax 401(k) if plan allows.

When it wins: high earners needing deductions or Roth space.

When to avoid: cash-flow issues or already overcontributed.

Get guidance from our Accounting & Tax Services – Tampa team.

2) Roth Conversion Window (2025–2028)

Use 2025 as a potential “low-rate” year to shift pretax balances to Roth.

-

Fill brackets strategically.

-

Pair with charitable gifts to offset.

When it wins: retiring early, income dip years, big RMDs ahead.

When to avoid: near Medicare IRMAA cliffs.

See how our Tampa IRS compliance specialists run conversion models.

3) Capital Gains, QSBS & Real Estate

-

Tax-loss harvest to offset gains.

-

Review QSBS (Section 1202) eligibility.

-

Use 1031 exchanges and cost segregation in Tampa real estate.

When it wins: concentrated stock positions or big liquidity events.

When to avoid: wash-sale traps or IRMAA surcharges.

4) Charitable Giving in 2025

-

Appreciated stock donations (skip gain, deduct FMV).

-

Bunch gifts with a donor-advised fund (DAF).

-

At age 70½+, use QCDs to lower AGI.

When it wins: high-income year or sale event.

When to avoid: if standard deduction still beats itemizing.

5) Estate & Gift Moves

-

Annual exclusion: $19,000 per donee.

-

Lifetime exemption: $13.99M (2025).

-

Vehicles: SLATs, GRATs, IDGTs, ILITs.

-

Florida’s homestead and TBE rules strengthen asset protection.

When it wins: multi-generational planning and large estates.

When to avoid: no heirs or limited estate exposure.

Start planning with the Leading CPA Firm in Tampa.

6) Business-Owner Tactics

-

Revisit entity choice and reasonable comp for S-corps.

-

Optimize QBI (199A) aggregation.

-

Layer cash balance + 401(k) plans.

-

Stay current on quarterly estimated taxes.

When it wins: consistent high business cash flow.

When to avoid: if income is highly volatile.

Use our Quarterly Estimated Taxes – Tampa Guide for deadlines.

7) Florida-Specific Asset Protection

-

Florida homestead provides unmatched primary residence protection.

-

Tenancy by the entirety (TBE) for married couples.

-

Coordinate LLCs and umbrella liability policies.

When it wins: high litigation or professional risk.

When to avoid: if property not primary residence.

Review structures with a trusted Tampa CPA.

Smart financial decisions start with the right conversation. Let’s figure out what works best for your business.

How-To: Plan a 2025 Roth Conversion in Tampa (5 Steps)

-

Project income to spot unused tax brackets.

-

Decide on target bracket (often 24% or 32%).

-

Convert IRA → Roth up to bracket ceiling.

-

Offset with deductions (charity, DAF, losses).

-

Recheck quarterly as income shifts.

Tampa & Florida Nuances

-

No personal income tax—federal planning dominates.

-

Homestead law protects primary residence value.

-

Tenancy by the entirety protects joint assets.

-

Maintain Florida domicile evidence (driver’s license, voter reg, declaration of domicile).

People Also Ask

How should Tampa high earners balance pre-tax vs. Roth in 2025?

Split funding: pre-tax for current deductions, Roth for long-term flexibility.

Is a donor-advised fund still smart in 2025?

Yes—front-load deductions in a high-income year, then grant slowly.

What’s the right cadence for estimated taxes in Tampa?

Quarterly; safe-harbor or current-year method. See our Tampa estimated taxes guide.

Do Florida homestead rules affect my trust plan?

Yes—coordinate trust, will, and deed to avoid conflicts.

Should I accelerate income or deductions in 2025?

If you expect higher future rates, accelerate income and defer deductions.

FAQ

Q1: What’s new for 401(k)s in 2025?

Employee deferral limit increased to $23,500.

Q2: How much can I gift in 2025?

$19,000 per recipient; $38,000 with spousal splitting.

Q3: Are HSAs more valuable in 2025?

Yes—limits rose, preserving the triple tax benefit.

Q4: What’s the estate exemption for 2025?

$13.99M per person.

Q5: Should I convert to Roth in 2025?

Yes if you have low-rate room; avoid IRMAA spikes.