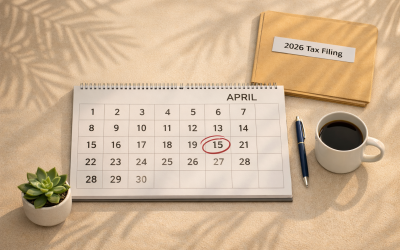

Quick Answer: Florida business owners must file federal taxes by April 15, 2026, with partnerships and S corporations due March 15. While Florida has no state income tax, businesses must meet sales...

Topic: Tax Planning

How Payroll Taxes Impact Small Businesses in 2026

Payroll taxes are mandatory employer and employee contributions, typically a fixed percentage of wages used to fund government programs such as Social Security, Medicare, and unemployment insurance,...

Florida Business Tax Basics: Federal, State, and Local Tax Obligations

Quick Answer: Florida businesses must handle federal income and payroll taxes, Florida corporate income tax for C‑corporations, state sales and use tax, reemployment tax for employers, and a mix of...

Step-by-Step Guide to Registering for Business Taxes in Florida

Starting a business in Florida? One of the essential early steps is registering for business taxes. Proper tax registration ensures your company operates legally and avoids costly penalties. Many...

End of Year Tax Tips: Maximize Savings For 2026

The end of the year is more than just a time for reflection and holiday celebrations, it's also the perfect moment to take strategic financial steps that can reduce your tax liability. By reviewing...

How Federal Taxes Affect Florida Businesses: A Comprehensive Guide for 2026

Florida is well-known for its unique tax advantages, most notably the absence of a personal state income tax. This feature makes it an attractive location for businesses and entrepreneurs alike....

How to Use IRS Installment Agreements for Past Payroll Taxes

Payroll tax debt can quickly become a critical issue for businesses, sometimes threatening to shut down operations within just 10 days. For Tampa business owners struggling with unpaid payroll...

Step-by-Step Guide to Outsourcing Payroll Tax Services to a CPA Firm

Quick Answer: Outsourcing your payroll tax to a CPA firm increases accuracy, ensures compliance, reduces risk and saves valuable time. In today’s dynamic business world, managing payroll tax...

5 Ways Cloud-Based Accounting Services Are Changing Finance Management in 2026

In 2026, cloud accounting services have become a vital part of business finance management in Orlando and beyond. Many companies are shifting away from traditional desktop accounting software due to...