Quick Answer: Choosing the right business entity structure in Florida — LLC vs S-Corp vs C-Corp — can significantly reduce your overall tax burden. Florida has no personal income tax, but your entity type determines how federal taxes, self-employment taxes, and corporate obligations apply to your business.

Understanding Florida’s Business Tax Landscape

Florida’s tax system is simple on the surface, but entity classification determines how much you’ll actually pay. While there’s no personal income tax, business owners still face federal obligations and potential corporate taxes depending on how they operate.

-

C-Corporations pay a 5.5% Florida corporate income tax and a 21% federal rate.

-

LLCs and S-Corps pass income through to owners, avoiding state-level income tax.

This makes Florida attractive for pass-through entities but less straightforward for companies planning large-scale growth or multi-state operations.

For ongoing compliance strategies, explore year-round tax planning in Tampa to see how Florida CPAs optimize tax obligations throughout the fiscal year.

Q: Does every business in Florida pay state income tax?

A: No. Only C-Corps and certain financial institutions pay Florida corporate income tax. Pass-through entities generally do not.

LLCs in Florida: Flexibility with Pass-Through Taxation

How LLC vs S Corp in Florida Affects Your Tax Outcome

A Limited Liability Company (LLC) provides a simple and flexible business structure with pass-through taxation. Profits are reported on your personal return, avoiding corporate-level tax.

However, one drawback is the self-employment tax, which is 15.3% on net earnings. That rate can make a big difference for high-earning owners.

Florida LLCs can choose to be taxed as S-Corporations to reduce this burden. In that case, the owner takes a salary (subject to payroll tax) and the rest as distributions that aren’t subject to self-employment tax.

Learn more about optimizing LLC structures in this guide to tax planning tips for Tampa business owners.

Q: Is an LLC better than a sole proprietorship in Florida?

A: Yes. LLCs provide liability protection and greater tax flexibility compared to sole proprietorships.

Q: Can LLCs avoid payroll taxes?

A: Not entirely. Self-employment tax still applies unless you elect S-Corp status.

S-Corporations in Florida: Lower Self-Employment Taxes

When comparing LLC vs. S-Corp in Florida, it’s important to understand that an S-Corporation isn’t a separate entity, but a federal tax election that an LLC or corporation can make for pass-through tax treatment.

S-Corporations in Florida allow business owners to pay themselves a reasonable salary subject to payroll taxes, then take remaining profits as distributions that are not subject to self-employment tax. For profitable businesses, this can significantly reduce overall tax liability compared to a standard LLC.

However, S-Corporations in Florida come with added compliance requirements, including payroll processing, quarterly filings, and proper recordkeeping. The IRS closely reviews S-Corp compensation, so maintaining accurate payroll and documentation is essential.

Refer to this quarterly estimated taxes guide for Tampa businesses for guidance on staying compliant.

Q: When should a Florida LLC elect S-Corp status?

A: Once your business earns around $50,000 in net profit, S-Corp status often reduces overall tax liability.

Q: What are common mistakes when filing as an S-Corp?

A: Setting an unreasonably low salary or missing payroll tax filings are common triggers for IRS audits.

C-Corporations in Florida: Built for Growth but Double Taxed

C-Corporations are separate legal entities that pay taxes on profits, then shareholders pay tax again when dividends are distributed — known as double taxation.

While that may sound inefficient, C-Corps are advantageous for raising capital, offering employee benefits, and retaining earnings within the company. Owners who also draw salaries can take advantage of deductible benefits like health insurance or retirement plans.

For accurate year-end filing, see corporate tax return preparation in Tampa and the guide on deferred tax assets and liabilities in Tampa for advanced corporate strategies.

Q: Do Florida C-Corps benefit from any special deductions?

A: Yes. C-Corps can deduct employee benefits, charitable contributions, and some retained earnings planning tools unavailable to S-Corps or LLCs.

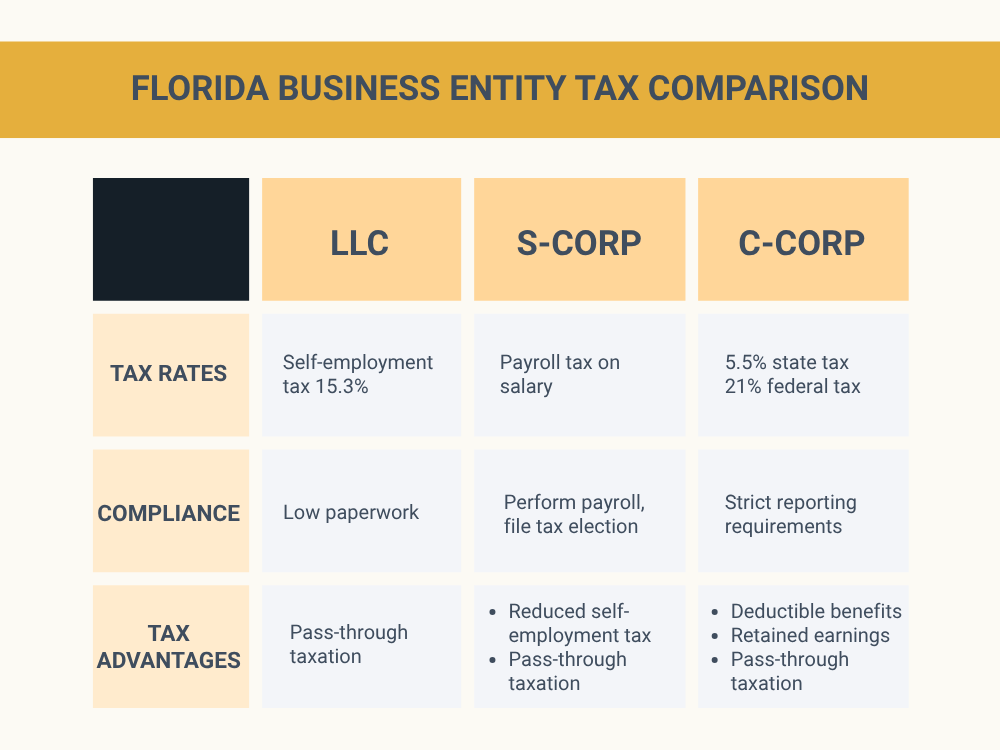

Comparing LLC, S-Corp, and C-Corp Structures in Florida

Here’s a side-by-side of LLC vs. S-Corp in Florida (and C-Corp) so you can see federal tax, state tax, best use case, and drawbacks.

| Entity Type | Federal Taxation | State Taxation | Best For | Drawback |

|---|---|---|---|---|

| LLC | Pass-through | No state income tax | Startups and small businesses | Self-employment tax |

| S-Corp | Pass-through with payroll | No state income tax | Established businesses earning $50K+ profit | Payroll complexity |

| C-Corp | Corporate and shareholder tax | 5.5% corporate income tax | Growth and investment | Double taxation |

To see how a professional accountant can simplify these differences, read outsourcing accounting and tax services. Experienced CPAs often save clients thousands by aligning entity selection with income and growth goals.

Q: Which Florida entity structure provides the most flexibility?

A: The LLC offers the greatest flexibility, but S-Corps often provide better long-term tax efficiency.

Common Tax Mistakes Florida Business Owners Make

Even in Florida’s favorable tax climate, errors in compliance or classification can be costly. Common mistakes include:

-

Not paying quarterly estimated taxes

-

Misclassifying salary vs. distributions

-

Missing federal filing deadlines

-

Failing to adjust the entity structure as profits grow

Learn more about avoiding IRS issues in the IRS audit help Tampa guide.

Also, bookmark Tampa tax filing deadlines for 2025 to prevent late fees and compliance penalties.

Q: Can Florida business owners be audited even with no state income tax?

A: Yes. Federal audits still apply, and errors in payroll or classification can trigger IRS scrutiny.

When to Switch Entities and How a CPA Can Help

As your company grows, your tax structure should evolve too. A setup that worked as a startup may not fit once you hire employees or expand operations.

If you’re unsure whether to remain an LLC or switch to S-Corp or C-Corp status, consult trusted tax experts in Tampa. A CPA can evaluate your situation, model potential savings, and handle IRS elections correctly.

Q: What’s the best time of year to change entity status?

A: Ideally, at the beginning of a new fiscal year to simplify recordkeeping and avoid mid-year payroll complications.

Smart financial decisions start with the right conversation. Let’s figure out what works best for your business.

FAQs About Business Entity Tax in Florida

1. In the context of LLC vs S-Corp in Florida, which entity is more tax-efficient?

LLCs and S-Corps usually offer the best mix of flexibility and savings. S-Corps reduce self-employment taxes for owners with higher profits.

2. How do I change my LLC to an S-Corp in Florida?

File IRS Form 2553 and consult a CPA to adjust payroll and recordkeeping correctly.

3. Do C-Corps pay Florida state tax?

Yes, at a rate of 5.5% on corporate income in addition to federal taxes.

4. When should a business convert from an LLC to a C-Corp?

When raising investor capital or retaining profits in the company for reinvestment.

5. Why should I consult a CPA before forming my business?

Because entity selection directly affects how much tax you pay, what you can deduct, and how easily you can grow.