Our Blog

What Services Do CPAs Offer Tampa Small Businesses?

Running a small business in Tampa comes with both opportunities and financial challenges. From tracking expenses to staying compliant with state and federal tax rules, it’s easy for owners to feel...

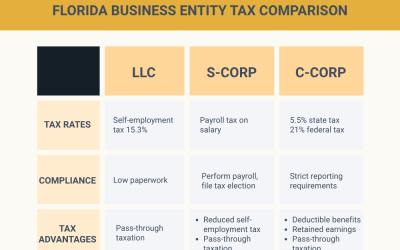

Tax Advantages of Different Business Entities in Florida: LLC vs S-Corp vs C-Corp

Quick Answer: Choosing the right business entity structure in Florida — LLC vs S-Corp vs C-Corp — can significantly reduce your overall tax burden. Florida has no personal income tax, but your...

Are There Year-Round Tax Planning Services in Tampa?

Many individuals still assume tax planning only matters during filing season, but experienced Tampa CPAs emphasize that it is a year-round process. Consistent planning helps you stay compliant with...

When Are Tampa Tax Filing Deadlines in 2025?

Tax season can feel overwhelming for both individuals and business owners in Tampa. Staying informed about Tampa tax filing deadlines for 2025 helps you stay compliant and avoid unnecessary...

Managing Remote Work Tax Compliance: An Employer’s Guide

According to recent IRS data, 47% of employers face significant penalties due to remote work tax compliance issues, with an average cost of $93,000 per violation. As businesses continue embracing...

Trusted Tax Experts in Tampa — Hacker, Johnson & Smith PA

Looking for a trusted tax expert in Tampa? For over 40 years, Hacker, Johnson & Smith PA has helped individuals and Florida businesses navigate tax complexity with clarity. As a locally based...

Understanding Deferred Tax Assets and Liabilities: A Guide for Business Owners

For many Tampa business owners, tax season can feel like a whirlwind of forms, filings, and unfamiliar terminology. One concept that often gets overlooked, but can have a significant impact on your...

Got an IRS Notice? Here’s What to Do First

If you’ve just received an IRS notice in the mail, take a breath. You’re not alone and you’re not necessarily in trouble. Every year, the IRS sends out millions of notices for reasons ranging from...

Do Florida Businesses Pay State Income Tax?

Florida is often called a tax-friendly state, but many business owners still wonder whether they owe state income tax. The answer depends on how their company is structured and which taxes apply...