If you’ve recently started earning in Tampa’s growing gig economy, whether that’s through freelancing, consulting, or launching a side business, chances are you’ve come across the topic of quarterly estimated taxes.

These are advance payments you make to the IRS throughout the year when your income isn’t subject to regular withholding like from a W‑2 job.

If you’re self-employed, earn rental income, or run a business in Tampa, estimated payments likely apply.

Missing them can lead to IRS penalties, even if your total tax owed is correct by year’s end.

If you expect to owe $1,000 or more after deductions and credits, you’re probably required to pay.

This guide will help you understand how quarterly taxes work, how to calculate your payments, when they’re due, and how to stay compliant, especially if you’re paying them for the first time.

Understanding Quarterly Estimated Taxes

Quarterly estimated taxes are advance payments toward your federal income tax.

They’re required if your income isn’t subject to withholding, like freelance, consulting, or small business earnings.

If you expect to owe $1,000 or more in taxes after subtracting credits and existing withholding, the IRS requires you to make these payments.

Many Tampa business owners miss this detail and get hit with penalties later.

This applies whether you’re a sole proprietor, S corporation owner, or independent contractor.

Even side hustles generating modest income may trigger the need for estimated payments.

Since these aren’t automatically deducted like a paycheck, you’re responsible for staying ahead of what you owe.

Understanding these rules is key to avoiding surprises and working with a qualified CPA in Tampa can help you navigate gray areas like irregular income or deductible expenses.

The sooner you start planning, the easier it is to stay compliant.

Key Deadlines for Tampa Residents

The IRS breaks the year into four payment periods: April 15, 2025; June 17, 2025; September 15, 2025; and January 15, 2026.

Even though Florida has no state income tax, you still need to stay on track with federal tax deadlines.

Late payments can trigger interest or penalty fees even if your final tax return is accurate.

It’s not just about hitting those dates; it’s about having accurate numbers ready ahead of time.

That’s why many Tampa freelancers and small business owners use tax software or hire a professional CPA to review their income quarterly and make sure estimates stay aligned with earnings.

Quarterly payments are especially important if your income changes month to month or comes from multiple sources. Planning early gives you more flexibility and fewer surprises.

Set calendar reminders before each deadline, keep a running log of your income and expenses, and avoid last-minute estimating to reduce stress.

How to Calculate Your Estimated Taxes

To estimate what you owe, start by figuring out your total expected income for the year. Subtract deductions or credits like the standard deduction or qualified business expenses.

Then apply the federal tax brackets to find your tax liability. If you’re self-employed, remember to include 15.3% in self-employment tax.

The IRS Safe Harbor Rule helps protect you from penalties. If you pay at least 90% of what you owe this year or 100% of what you owed last year, you’re in the clear (or 110% if your income exceeds $150,000).

Tampa freelancers often use this rule to stay safe when their income varies.

You can do the math yourself with IRS Form 1040-ES or get help from a local CPA who knows how to fine-tune your numbers based on local business activity and real-time earnings.

Simple Quarterly Tax Calculator Guide

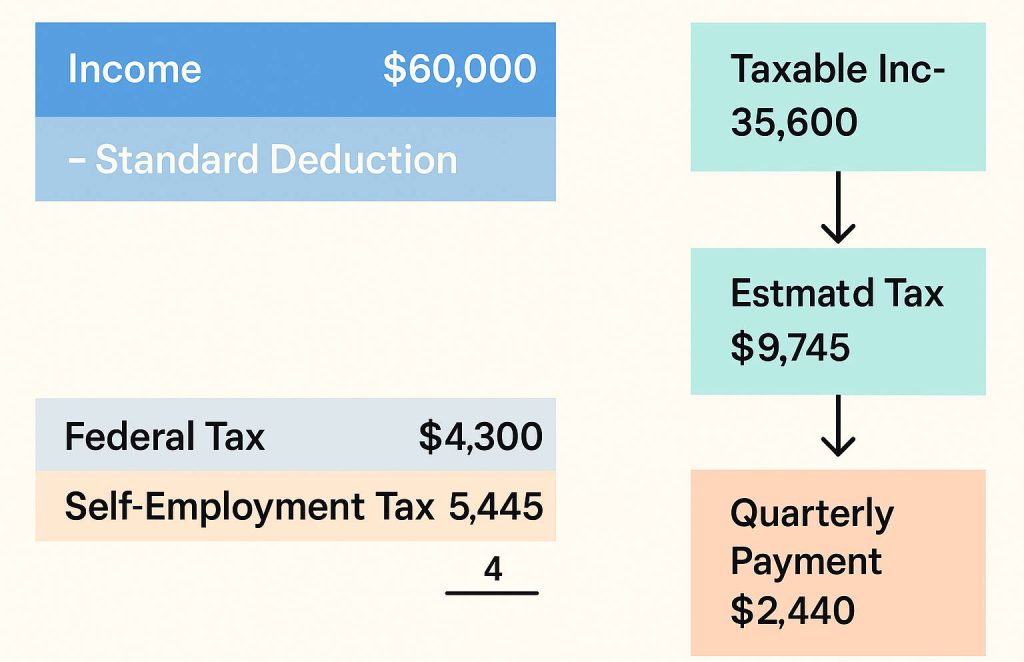

Let’s say you’re a freelance graphic designer in Tampa earning about $60,000 this year. After taking the standard deduction of $24,400, you’re left with $35,600 in taxable income.

That results in roughly $4,300 in federal tax. Add around $5,445 in self-employment tax, and your total estimated tax for the year is $9,745. Split that into four payments of about $2,440.

Of course, this is just an estimate. Income changes? Adjust your next payment. Don’t wait for tax season to fix underpayment, it’s easier to stay current with quarterly guidance from a pro.

Tips to Stay on Track and Avoid Mistakes

Here are common mistakes Tampa filers make and how to avoid them:

- Assuming estimated taxes don’t apply to small side gigs

- Forgetting to factor in self-employment tax

- Overestimating deductions and underpaying

- Missing deadlines by not setting reminders

- Using outdated income estimates without adjusting

Use digital tools like QuickBooks or Wave to track your income throughout the year. Even better, many local accountants offer quarterly check-ins to keep you aligned with your income and estimated obligations.

What Happens After You File Your Estimated Taxes?

Once you’ve made all four payments, everything gets reconciled on your annual tax return. The IRS matches your actual tax owed against your estimated payments.

If you’ve overpaid, expect a refund. If you underpaid, you’ll settle the difference in April, possibly with interest if the shortfall was significant.

Planning ahead keeps you in control. That’s why many growing businesses in Tampa rely on quarterly CPA check-ins to help adjust estimates and avoid surprises.

These sessions also provide a chance to review deductions, income trends, and business changes that could affect your tax picture before year-end.

FAQs About Quarterly Estimated Taxes in Tampa

Am I required to pay quarterly estimated taxes if I have a full‑time job but also freelance on the side?

Yes. If you expect to owe at least $1,000 in taxes from that freelance income, the IRS expects quarterly payments even if you already have taxes withheld from your main job.

What if I underpay one quarter — can I make it up in a later payment?

You can catch up later in the year, but the IRS calculates penalties quarterly. Paying late, even if you fix it, could still cost you.

Can I adjust my payment amounts if my income changes during the year?

Definitely. If your income rises or falls, update your projections and adjust your next payments. A local CPA can help you revise your numbers accurately.

How do I actually make the payments from Tampa?

Use IRS Direct Pay, EFTPS (Electronic Federal Tax Payment System), or mail in a check with Form 1040-ES. Most Tampa filers prefer Direct Pay, it’s fast, secure, and sends you a confirmation.

What if I end up overpaying?

No worries. The overpaid amount will be refunded or applied to your next tax year, your choice when you file.

Talk to a CPA Who Gets It

Talk to a CPA Who Gets It

Smart financial decisions start with the right conversation. Let’s figure out what works best for your business.

Smart financial decisions start with the right conversation. Let’s figure out what works best for your business.

Next Steps

Quarterly estimated taxes might seem overwhelming at first, but with the right system and support, they become part of your business rhythm.

You don’t need to be a tax expert to get this right. Stay organized, use tools that track your income, and don’t hesitate to ask for help.

Even simple spreadsheets or free apps can make a difference, especially when you’re juggling multiple income streams.

As your income grows, so does the complexity. That’s when it pays to have a Tampa-based CPA on your side, someone who understands both the IRS and local small business needs.

A professional can help you fine-tune deductions, adjust your estimates in real time, and ensure you’re not leaving money on the table.

Making quarterly payments isn’t just about compliance; it’s about staying in control of your finances. Break it down quarter by quarter, and the whole process becomes much easier to manage.

You’ve already taken the hardest step by learning. Now it’s just about execution. Set reminders, revisit your estimates, and stay proactive.

You’ve got this and if you ever feel stuck, expert support in Tampa is only a call away.